In the Philippines, there are many reputable lenders that offer fast loan in 15 minutes. They can be a great help in times of need. However, it’s important to understand how to choose a lender that is right for you.

There are a number of factors that can affect your loan approval and release. First, check the requirements that your lender has. There are some that will be easy to meet, and others that may be a bit more difficult. Then, read through the terms and conditions to make sure you’re comfortable with them before submitting your application.

Getting a Cash Loan in 15 Minutes

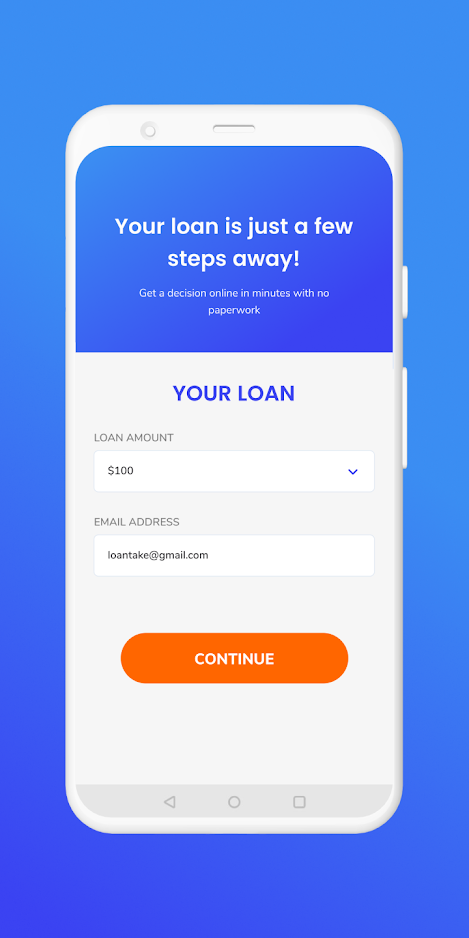

The fastest way to get a cash loan is to use online loans. These are short-term loans that can be used for a variety of purposes. Some of these include medical emergencies, debt consolidation, and other needs. They can be paid back in installments or in one lump sum.

These loans are generally available at lower interest https://alloansonline.com/lenders-loan/cashwagon/ rates than other types of loans, and they’re typically easier to qualify for. They’re also generally more flexible, so you can choose how much money you want to borrow and for how long.

Some online lenders even offer quick loans with no credit check! This is a great option for people with poor credit who are looking to get a small loan.

If you are trying to get a loan with no credit check, you will need to provide some personal information and documents. These can include your income, employment history, and bank account information.

In some cases, you can also provide collateral or a guarantor. These are a good way to ensure that you’re approved for the loan, but they can also be expensive.

Another way to get a fast loan is through a pawnshop or a local lender in your area. These are often less expensive than online loans, and they can be a good option for anyone who doesn’t want to deal with an online lender.

To get a cash loan from a pawnshop, you’ll need to bring some cash with you to the store. They’ll then check your identification and verify that you have the proper amount of money to pay for the loan.

Some pawnshops will require you to show some collateral as a security for the loan, but they can usually get you approved quickly. They’ll also take your ID and bank account information so they can deposit the money in your bank.

Robocash is a fast loan company that offers a range of loans for both personal and business purposes. You can apply for a loan on their website or through the app. They’ll let you know if you’ve been approved within an hour.

There are also some lenders that provide a no credit check loan in the Philippines. These companies are great for those who have a poor credit score but need to get money as quickly as possible.

Digital banks

These are new loan companies in the Philippines that focus on digital lending. They’re usually focused on the middle class of the country, and they typically approve loan applications in less than 15 minutes.

Comentários